Funding boost for award-winning spinout company

An award-winning University of St Andrews spinout company has received a major funding boost to take on the healthcare market.

MOFgen, which is pioneering cutting-edge technology for coating medical devices, has received investment totalling £300,000 from Mercia Fund Management and the Scottish Investment Bank. The investment will allow MOFgen to further the commercialisation of its products that will reduce Healthcare Acquired Infections (HAIs), prevent procedural complications and improve healing rates.

This seed investment comes on the heels of MOFgen winning first prize in this year’s Royal Society of Chemistry Emerging Technologies Competition and marks the culmination of intensive technical and commercial development by the St Andrews-based team.

MOFgen was formed to commercialise research into the development of metal-organic frameworks (MOFs) for biomedical applications conducted in the laboratories of Professor Russell Morris at the University’s School of Chemistry.

MOFs are powdery solids with microscopic pores that can be loaded with antibacterial, wound healing and anti-thrombotic agents such as antibiotics, bioactive gases and metal ions. Acting like reservoirs, they can be incorporated into coatings on medical devices and wound dressings to provide slow and controlled release of the active agents during the lifetime of the product.

As well as improving the quality of patient care, reducing infection rates and reducing the added burden on NHS resources caused by lengthy and repeated hospitalisation, their novel and multifunctional mode of action is expected to help in the fight against antibiotic resistant bacteria and provide alternatives where patient intolerances to current coatings exist.

MOFgen is preparing a library of products that can be adapted for and used by its customers to enhance the performance of their own product lines. The technology has already been validated by key industry partners and will now begin to penetrate its first target markets: medical devices and consumer healthcare.

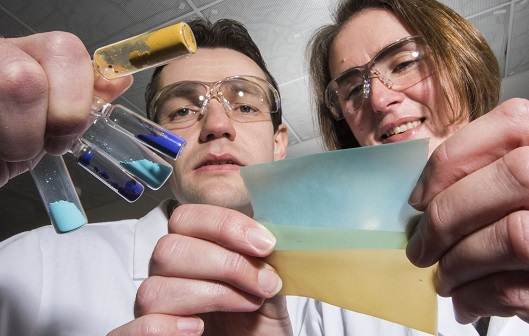

The new company is led by a strong team that combines expertise in the medtech market – CEO Dr Yvonne Davies and Chairperson Dr Ian Muirhead – and new technology commercialisation – Dr Stewart Warrender, Research and Technology, and Dr Morven Duncan, Applications Development (both pictured above and right).

The new company is led by a strong team that combines expertise in the medtech market – CEO Dr Yvonne Davies and Chairperson Dr Ian Muirhead – and new technology commercialisation – Dr Stewart Warrender, Research and Technology, and Dr Morven Duncan, Applications Development (both pictured above and right).

Professor Russell Morris, Chief Scientific Officer at MOFgen Ltd, said: “We are delighted to secure this investment as we really believe that our technology will make a significant and positive difference for those people who suffer from chronic wounds and secondary infections.”

Professor Verity Brown, Vice-Principal (Enterprise and Engagement) at the University of St Andrews, said: “The team’s world-leading research into MOFs has been supported by funding from the University, Scottish Enterprise, The Royal Society and the European Research Council. We are thrilled that investors have recognised the commercial potential of the spin-out company, MOFgen.”

The MOFgen funding is the second co-investment undertaken by Mercia and the Scottish Investment Bank.

Paul Devlin, Investment Manager for Scotland at Mercia, said: “MOFgen is another example of the high-quality research and technology that Scottish universities are developing. The MOF technology has already won several awards, secured grant funding and received interest from commercial partners in the medical devices industry.

“The investment supplied by Mercia and the Scottish Investment Bank will help the new business to continue validating its technology and build commercial traction in its initial target markets.”

Notes to news editors

Photograph caption: Dr Morven Duncan and Dr Stewart Warrender in the MOFgen development lab in the School of Chemistry at the University of St Andrews.

Issued by the University of St Andrews Communications Office, contactable on 01334 467310 or [email protected].

Category Business