Can a CEO’s cultural heritage affect corporate performance?

Do the cultural values we inherit from our ancestors affect our decision-making in the present time? A study of US banking CEOs, led by academics at the University of St Andrews and the University of Edinburgh, has found that cultural heritage can shape managerial behaviour and influence corporate performance and profitability.

The ground-breaking study asked whether a CEO’s cultural heritage, traced back several generations, can affect corporate investment policies and overall organisational performance. Research focussed on banks led by CEOs who were children and grandchildren of immigrants, who are exposed to the same legal, social, and institutional conditions as other US-born CEOs, but they possess a cultural heritage influenced by the countries that their parents or grandparents have emigrated from, which is different from that of other CEOs.

It found that CEOs whose cultural heritage is characterised by lower individualism, higher uncertainty avoidance and higher restraint are more likely to outperform under pressure. Results further suggest that cultural heritage plays a larger role in explaining competitive performance relative to genetic differences between people in their countries of origin.

The findings imply that CEOs whose ancestors were from Germany, Italy, Poland and Russia are associated with better bank performance under competitive pressures. Whereas CEOs with British or Irish ancestors do not display different performance from the rest of the sample.

Dr Louis Nguyen, Lecturer from the School of Management at the University of St Andrews, said: “Cultural heritage is a topic of significant interest to policymakers. A growing body of research shows that managerial traits explain a lot of the variation in a firm’s capital structure, investment, and profitability. These studies investigate the usual attributes, such as age, gender, experience and educational achievement, but the role of cultural heritage in shaping managerial behaviour and firm outcomes has been overlooked.

“Our research shows that the cultural values that can be traced back generations ago can influence decision-making in the present time. This implies that culture is deeply-rooted and slow-moving. Our study is especially timely, given the ongoing debate about immigrants around the world.”

Professor Jens Hagendorff, Chair in Finance at the University of Edinburgh Business School, added: “At a time when the economic benefits of immigration are increasingly questioned, our study offers a glimpse of the positive and lasting contribution that people of immigrant heritage make in the business world.”

The study demonstrates that banks led by CEOs whose cultural heritage emphasises restraint, group-mindedness, and long-term orientation are safer, more cost efficient, and are associated with more cautious acquisitions which, in turn, explains their outperformance.

To identify cultural heritage, academics collected data on the country of origin of a CEO’s ancestors from Ancestry.com, the world’s largest genealogy database, which has access to almost 17 billion family histories. Researchers were able to trace a CEO’s ancestors by using the name, birthplace, and birth year to identify parents, and then doing the same for parents to identify grandparents. This allowed the team to map a CEO’s family tree for up to six generations.

Researchers were able to identify a CEO’s ancestral country, and how many generations ago ancestors moved to the US. For instance, James Dimon, CEO of JP Morgan, is a third-generation descendant of Greek immigrants to the US. John Stumpf, a former CEO of Wells Fargo, is a third-generation descendant of German immigrants to the US.

Findings are consistent with the hypothesis that the culture of a CEO’s ancestors influences his or her decision-making behaviour, firm policy choices and performance. Results also show that the performance effects of cultural heritage depend on the market environment in which a CEO operates.

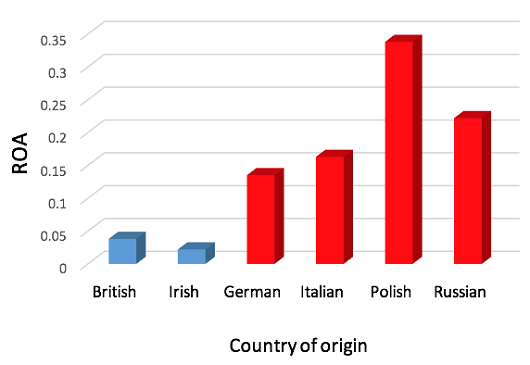

Figure 1 CEO country of origin and competitive performance

Figure 1 shows the additional Return On Assets (ROA) associated with CEOs, by the country that a CEO’s ancestors were from. The red bars indicate that the effect is statistically significant different from zero (5% probability). The blue bars indicate that the effect is not statistically significant.

Background information

Dr Nguyen is available for interview. To arrange an interview please contact the University of St Andrews Communications Office in the first instance: contact details below.

St Andrews has an in-house ISDN line for radio and a Globelynx camera for TV interviews.

Professor Hagendorff is also available for interview. Please contact Edd McCracken, PR & Media Manager for the College of Arts, Humanities and Social Science, University of Edinburgh. Tel: 0131 651 4400 Mob: 07557502823 Email: [email protected]

The report was co-authored with Dr Arman Eshraghi, Senior Lecturer in Finance at the University of Edinburgh Business School.

The full journal article ‘Does a CEO’s cultural heritage affect performance under competitive pressure?’ is available online.

Issued by the University of St Andrews Communications Office. Contact Christine Tudhope on 01334 467 320 / 07526 624 243 or [email protected].

Category Business